RiskIQ

Turn Client Anxiety Into Confidence With Ongoing Risk Alignment

Give clients complete risk clarity for their wealth goals: what they're willing to risk, what they need to risk.

The Problem

Research proves what you already know: age stereotypes don't work, and subjective terms like 'moderately aggressive' confuse everyone.

Risk tolerance vs risk capacity issue

Most platforms average together risk tolerance and risk capacity scores, which can result in clients with extremely low risk tolerance ending up with portfolios that are far too risky for their situation. 1

Evolution over time

Lack of customization

Confused clients

The costly result

Over 20% of clients

leave their advisor within the first year.

With poor understanding of their risk willingness as one of the top three reasons cited 3. When you can't truly understand and track how your clients think about risk, you lose credibility and clients.

Your Guide to Science & Evidence Based Risk Intelligence

RiskIQ is built on Nobel Prize-winning behavioral finance research.

We understand the frustration of having sophisticated risk tools that don't solve your real problems.

Basic Scores Behavioral Science

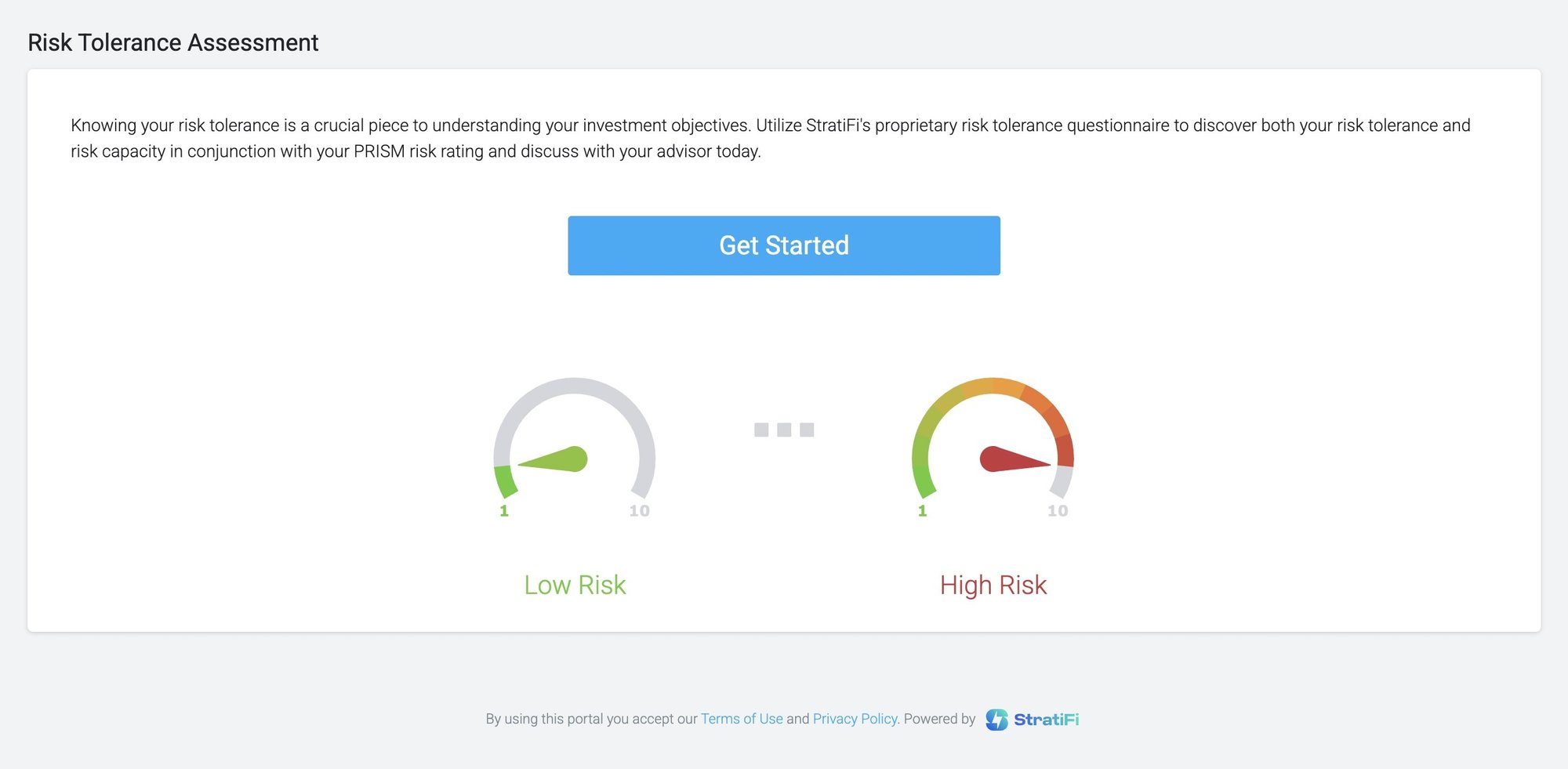

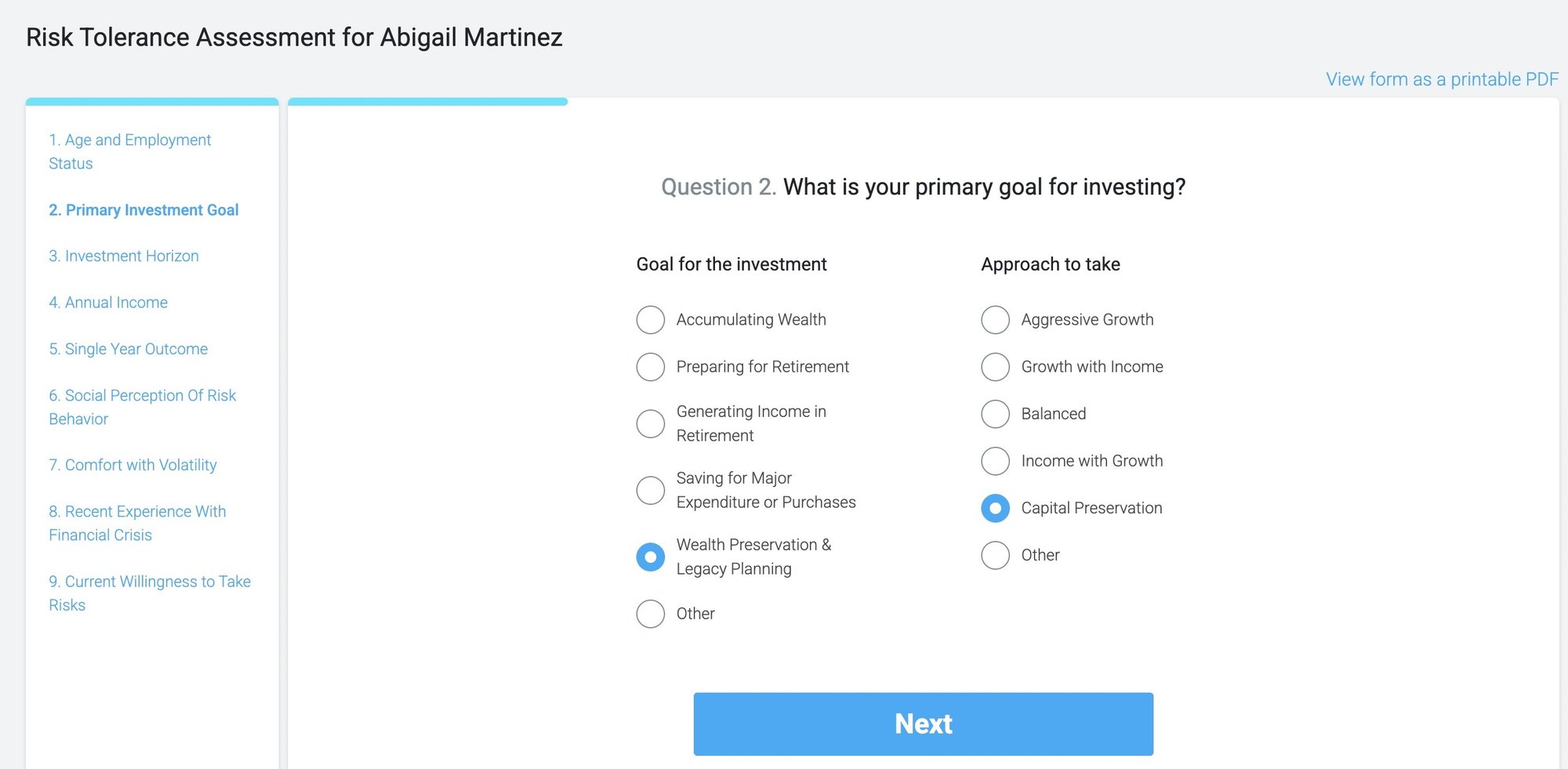

Risk Assessment

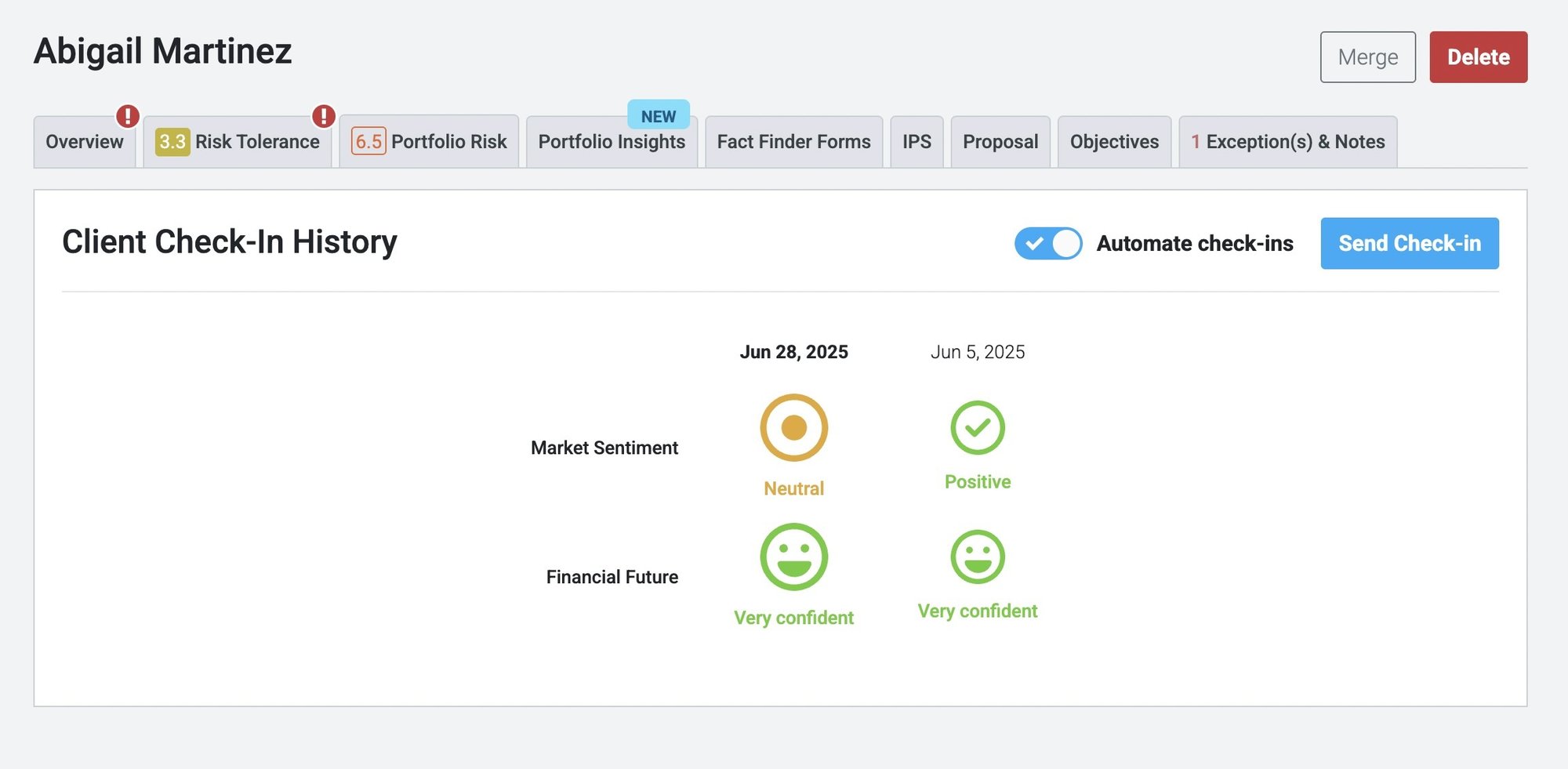

Behavioral Check-In

Evolution Timeline

Guarantee Portfolio Fit With Risk Alignment & Check-Ins

Be the advisor who truly understands the psychology behind your client's risk tolerance. While others provide basic risk scores, you'll have behavioral insights grounded in Nobel Prize-winning research.

Behavioral Finance Intelligence

-

Risk ability vs tolerance clarity

Separate assessment of willingness vs. ability to take risk

-

Behavioral check-ins that capture current emotional state

Regular check-ins to track how clients feel about goals and markets

-

Visual timelines showing psychological patterns over time

Visual timelines showing how risk profiles change over time

Customization & Workflow

-

Complete customization

From questionnaire completion directly to booked meetings

-

Seamless client workflow

From questionnaire completion directly to booked meetings

-

Ultimate flexibility

Send links, conduct in-person, use PDFs, or document answers

Institutional Compliance

-

Entity Support

Specialized frameworks for institutions, trusts, foundations

-

Automatic documentation

Complete records to meet suitability and SEC compliance requirements

Real Impact

- Deeper client relationships

- Better risk alignment

- Fewer emotional investment decisions during market stress.

just another advisor

Achieving 95%+ retention rates

What our customers are saying

"StratiFi has been a game-changer for me. In the past, other platforms I’ve used were not realistic with risk tolerance. But with StratiFi, everything makes sense. I feel more comfortable and confident sitting down with clients."

DeTray Investment Group

"StratiFi was able to help me (1) create a better digital experience for clients and (2) monitor compliance across multiple advisors who are running different strategies.”

NobleBridge Wealth

Management

"We wanted a risk profiling partner that shares our passion for leveraging technology to create better outcomes. After a year of due diligence, the technology, culture, and team at StratiFi were the perfect fit.

.png?width=53&height=53&name=Frame%201321319403%20(1).png)

UX Wealth

Become Their Trusted Wealth Coach

Move beyond confusing risk scores to dynamic behavioral intelligence that evolves with your clients and transforms how they think about their financial future.

Turn risk assessment from guesswork into behavioral science.

Frequently Asked Questions

We're here to help answers to some top questions from investors like you.

-

What is StratiFi?

StratiFi’s PRISM technology provides Factor-based risk analysis that is deep and robust. This allows you to distinguish between factors that increase upside potential from factors that reduce downside risk. Our client profiling questionnaire evaluates both risk tolerance and financial capacity to help you identify a suitable portfolio for your clients to meet their goals.

Our platform is sophisticated yet simple so you know what drives risk and can explain it to clients. -

Who uses StratiFi?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

How is StratiFi different?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

What type of investments does StratiFi support?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

What is StratiFi?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

What types of trading services do you offer?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features