Use AI trained by top independent wealth firms, engineered with sophisticated quant finance & grounded in proven behavioral finance.

Extract Documents

Align Portfolio Risk

Digitize Books & Records

Model Alternative Investments

Automate Compliance

Trusted By Firms With

$100B+ ASSETS

Under Management

The wealth managment problem

Wealth Management Firms Are Caught In An Impossible Squeeze

The next-gen revolt

Your clients' children will inherit $68 trillion - and 81% plan to fire their current advisors, seeking firms with sophisticated investment offerings, superior technology, and digital capabilities.

The talent shortage

McKinsey projects a 100,000 advisor shortage by 2034. The problem? You can't attract or retain talent without proper systems to transfer knowledge and onboard effectively.

The data fragmentation crisis

Essential client intelligence is scattered across PDFs and siloed systems, while top advisors leave for technology-superior firms each departure costs $50-100M+ in assets.

The compliance nightmare

With SEC fines reaching $8+ billion in 2024 for RegBI violations, share class issues, and reverse churning - firms with manual compliance processes are sitting ducks for these expensive violations.

Can fiduciary financial advisors capture the $68 trillion wealth transfer opportunity and avoid $8+ billion in SEC fines with excel sheets, data silos and disconnected tools?

Powering a New Era of Intelligent Wealth Management

AWARD-WINNING PLATFORM

3x T3 All-Star Software, 2x WealthManagement.com Awards Winner

$100 BILLION+ PLATFORM ASSETS

Battle-tested for Compliance Audits & Prospect Meetings

9/10 CUSTOMER SATISFACTION

Built By Independent Firms For Independent Firms In Partnership With StratiFi

What our customers are saying

StratiFi has been a game-changer for me. In the past, other platforms I’ve used were not realistic with risk tolerance. But with StratiFi, everything makes sense. I feel more comfortable and confident sitting down with clients."

Deb DeTray

Advisor,

DeTray Investment Group

Hit 5 million AUM in a month"

was able to close $5 million in new AUM in a month using StratiFi to clearly showing risk and reward type scenarios.

Deb DeTray

VP,

Game Changer Wealth

Hit AUM goals in 3 months"

was able to hit his year end goal of new AUM added - in just three months.

Mike Trent

Advisor,

Blueline FP

StratiFi was able to help me (1) create a better digital experience for clients and (2) monitor compliance across multiple advisors who are running different strategies.”

Corey Franco, CFS®

President,

NobleBridge Wealth Management

We wanted a risk profiling partner that shares our passion for leveraging technology to create better outcomes. After a year of due diligence, the technology, culture, and team at StratiFi were the perfect fit.

.png?width=53&height=53&name=Frame%201321319403%20(1).png)

Kyle Wiggs

President and Founder,

UX Wealth

Save 5 hours per proposal"

used to spend 4-5 hours building each proposal. With StratiFi, she's able to create fully customizable proposals in seconds.

Gail Murdoch

Certified Financial Planner,

Cardinal Investment Group

Hit 5 million AUM in a month"

was able to close $5 million in new AUM in a month using StratiFi to clearly showing risk and reward type scenarios

Matt Hollander

VP,

Game Changer Wealth

StratiFi has been a game-changer for me. In the past, other platforms I’ve used were not realistic with risk tolerance. But with StratiFi, everything makes sense. I feel more comfortable and confident sitting down with clients."

Deb DeTray

Advisor,

DeTray Investment Group

Hit AUM goals in 3 months"

was able to hit his year end goal of new AUM added - in just three months

Mike Trent

Advisor,

Blueline FP

StratiFi was able to help me (1) create a better digital experience for clients and (2) monitor compliance across multiple advisors who are running different strategies.”

Corey Franco, CFS®

President,

NobleBridge Wealth Management

We wanted a risk profiling partner that shares our passion for leveraging technology to create better outcomes. After a year of due diligence, the technology, culture, and team at StratiFi were the perfect fit

Kyle Wiggs

President and Founder,

UX Wealth

Save 5 hours per proposal"

used to spend 4-5 hours building each

proposal. With StratiFi, she's able to create fully customizable proposals in seconds

Gail Murdoch

Certified Financial Planner,

Cardinal Investment Group

Who We Serve

Turnkey Asset Management Platforms (TAMPs)

Insurance Marketing Organizations (IMOs)

Banks

Credit Unions

Become the Unstoppable Force That Competitors Can't Match

Power Your Firm With An AI Operating System Purpose Built For The Wealth Management Industry

BEFORE StratiFi

- 15+ disconnected software tools

- Capacity capped at 150 clients

- Generic proposals taking weeks

- 60% time on operations, 40% clients

- Struggling independent advisor

- Worrying about SEC examinations

AFTER StratiFi

-

One unified AI operating system

-

500+ client capacity with better outcomes

-

Personalized proposals in minutes

-

20% operations, 80% high-value client work

-

Market-leading transformation pioneer

-

Confident in bulletproof audit readiness

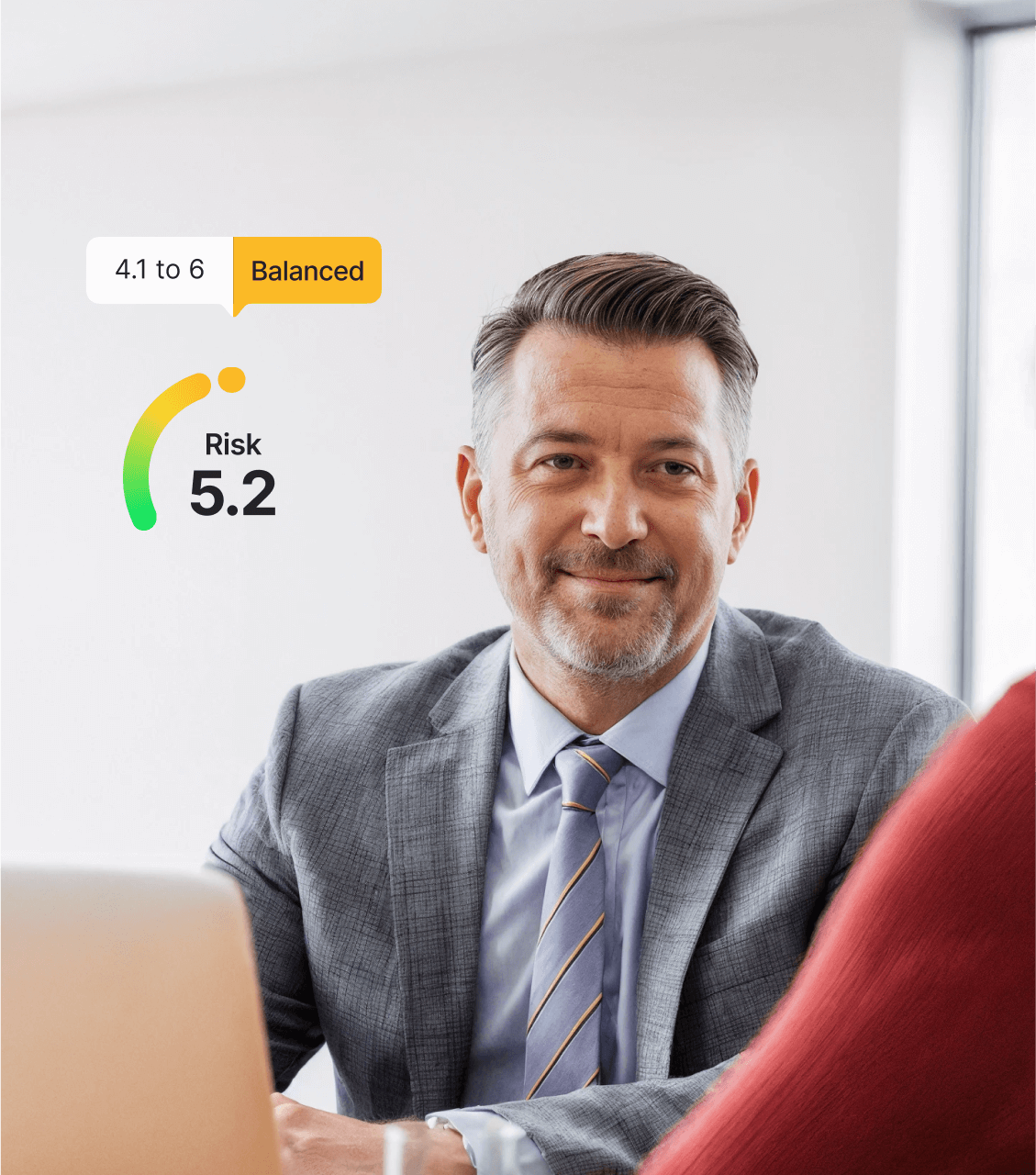

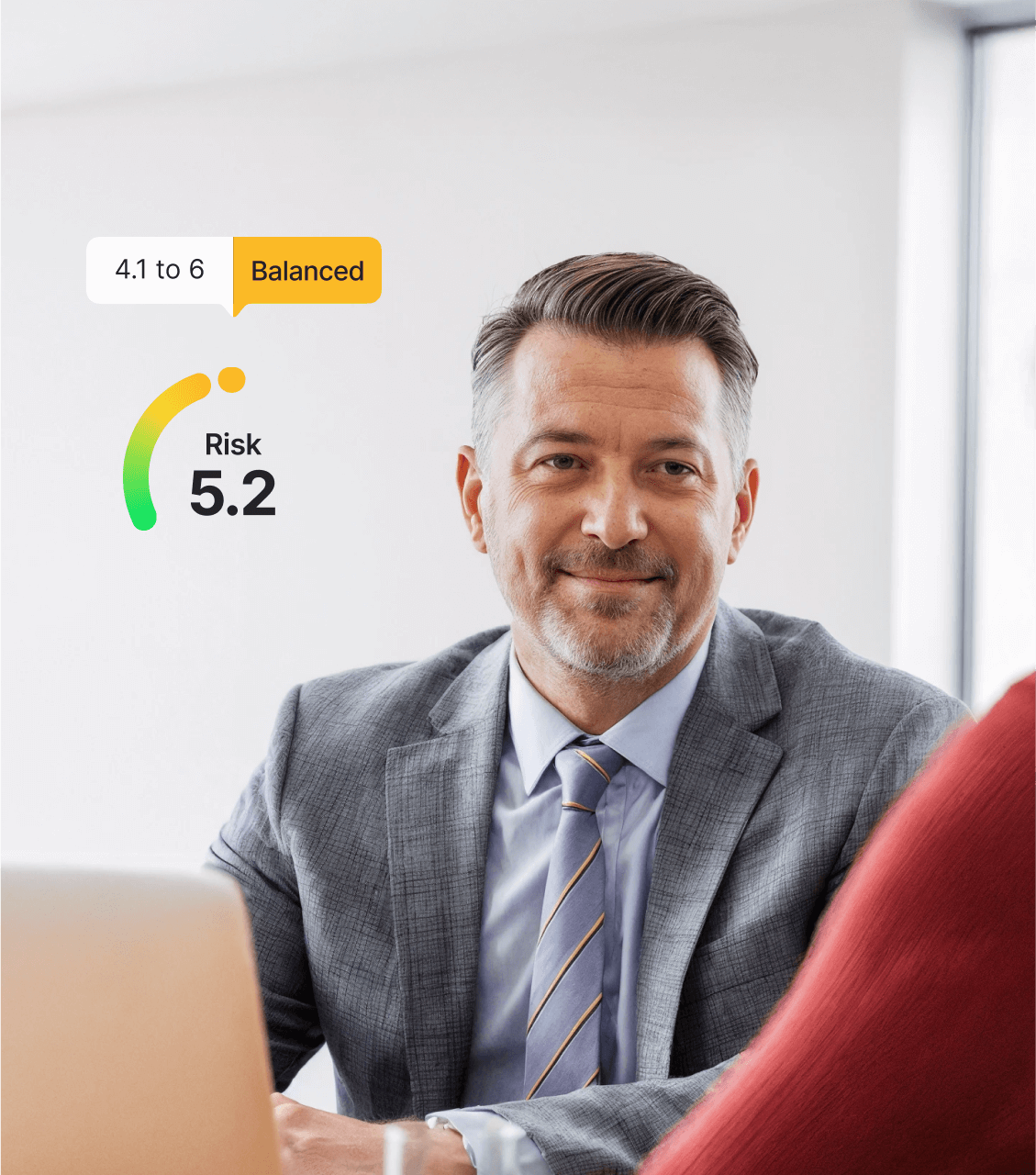

Guarantee Client Portfolio Fit With Ongoing Risk Alignment

Use Nobel Prize-winning behavioral finance & CFA research to help clients take appropriate risk across traditional portfolios, alternatives, structured products, annuities & buffer products to meet their goals.

Convert Statements Into Insights, Proposals & IPS

Save hundreds of hours & thousands of dollars by replacing multiple tools with one system that streamlines data extraction, deep research, proposal, and ips investment operations workflow.

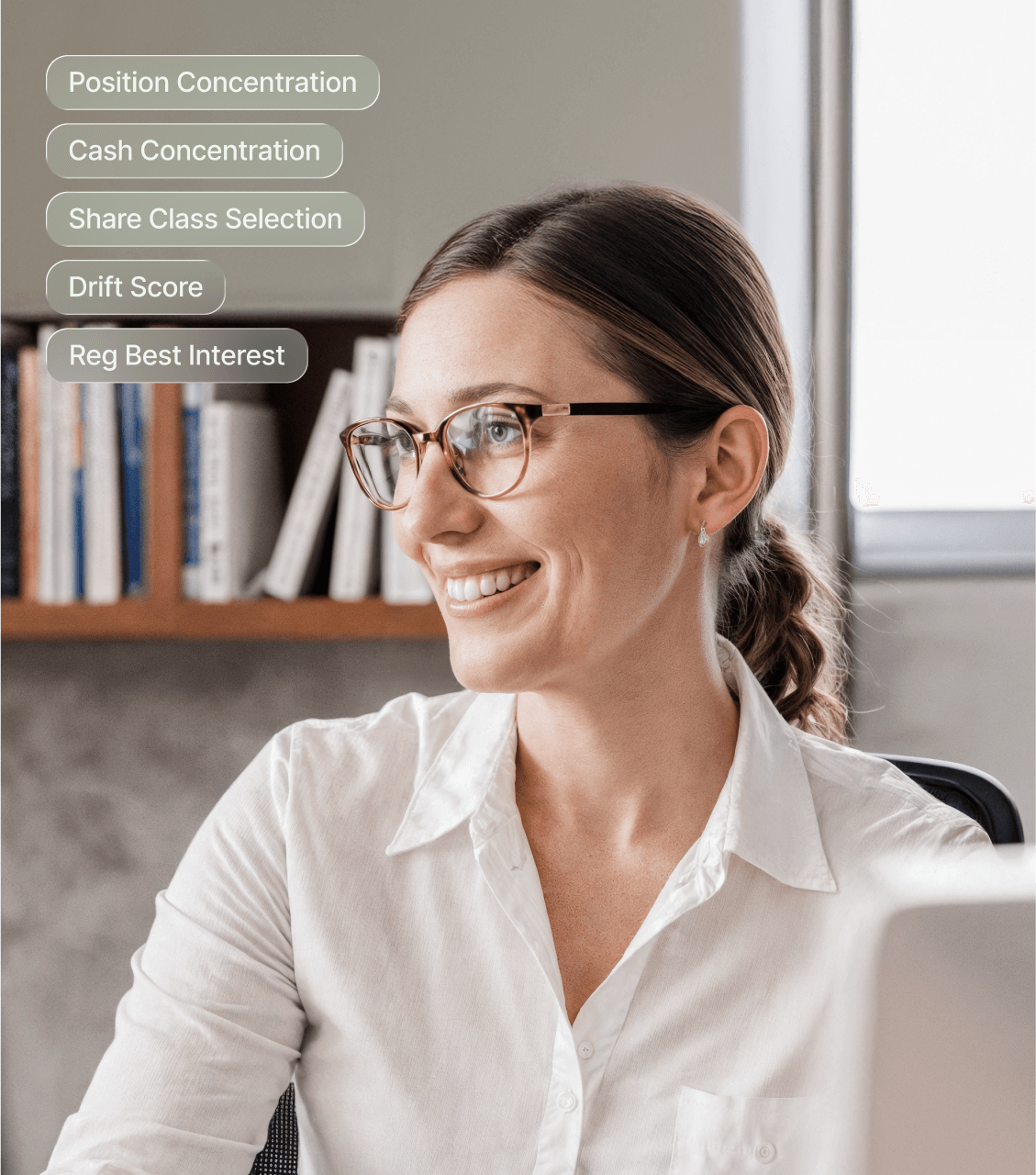

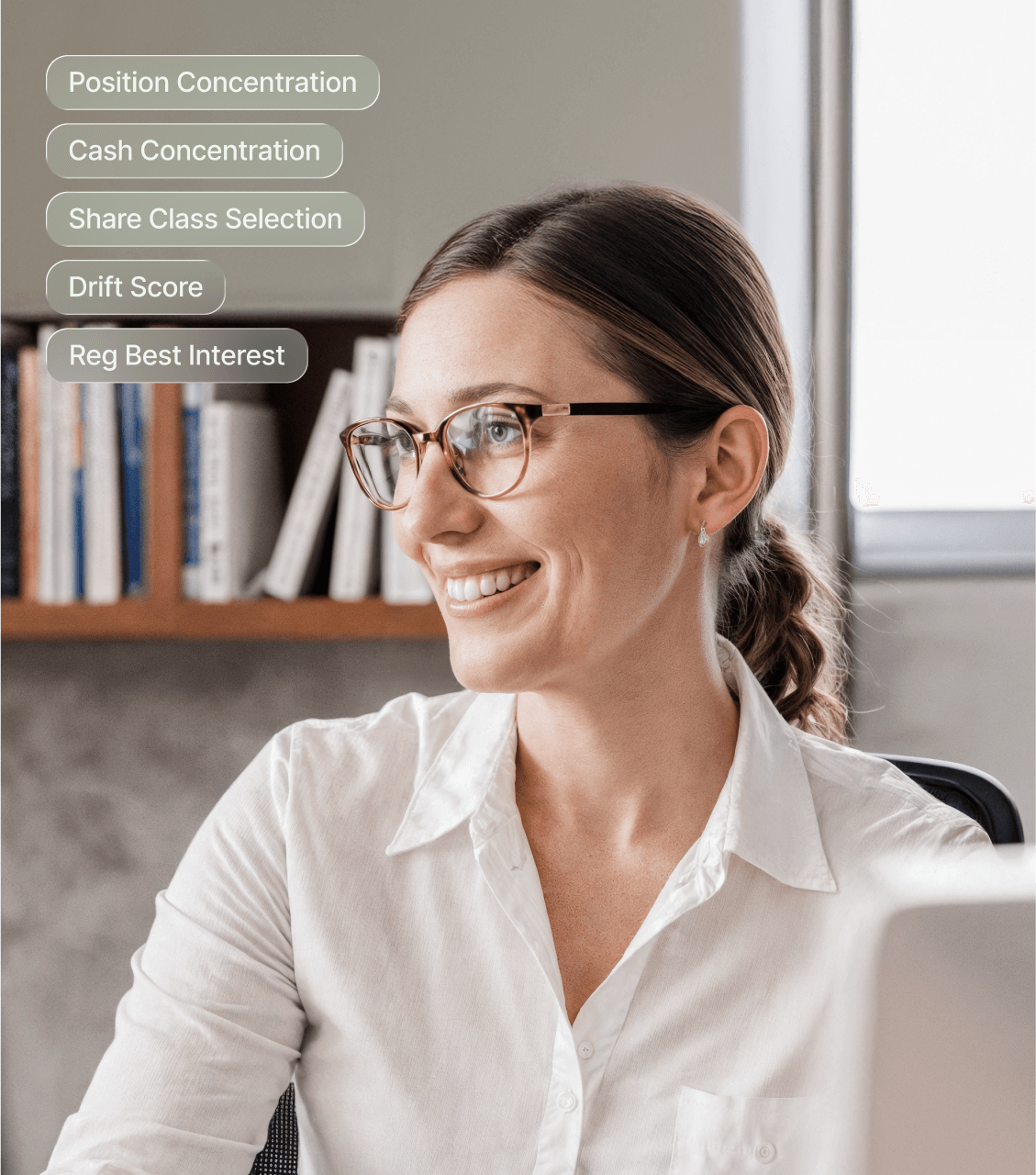

Meet SEC Requirements With Automated Compliance Alerts

Avoid $500K+ in fines with our unified compliance dashboard validated by top compliance officers at leading RIAs to catch Reg BI, mutual fund share class, cash & position concentration, trading activity violations & more.

Create Factsheets & Research Investments Effortlessly

Replace manual investment research with AI-powered analysis that generates factsheets and evaluates portfolio transitions in minutes, reducing investment committee prep time by 75%.

Build Comprehensive Books & Records That Are Audit Ready

Replace outdated synthetic records that capture only 50% of client data with digital books that capture 100% of information and update automatically as clients' lives change, ensuring full SEC compliance.

.png)

.png)

Onboard New Teams To Power Advisor Platform Growth

Grow your enterprise by acquiring and onboarding teams 10x faster by replacing your excel files with an AI co-pilot to transition thousands of accounts into your models & streamline paperwork to gain new AUM.

.png?width=656&height=220&name=persona-04%20(1).png)

.png?width=656&height=220&name=persona-03%20(1).png)

.png?width=656&height=220&name=persona-02%20(1).png)

.png?width=656&height=220&name=persona-05%20(1).png)