ComplianceIQ

Prevent SEC Fines with Automated Compliance Monitoring

Automatically monitor every account for share class violations, concentration risk, and suitability issues.

The Problem

You manage SEC compliance for hundreds of advisors with a tech stack made of excel, manual reviews, custodian reports, and email reminders.

Fragmented systems

Manual monitoring

Your testing only covers a fraction of accounts leaving most accounts exposed to undetected violations.

Investment Complexity

Regulatory scrutiny

The costly result

$8.2 billion in Fines

in fiscal year 2024

With individual penalties reaching $50 million per firm. Without systematic compliance monitoring, you're operating with dangerous blind spots that put your firm at risk.

Your Guide to RegBI Compliance

Designed by Compliance experts who understand your daily reality

Automatically track accounts for violations in one unified dashboard

Reactive Fire-fighting Proactive Oversight

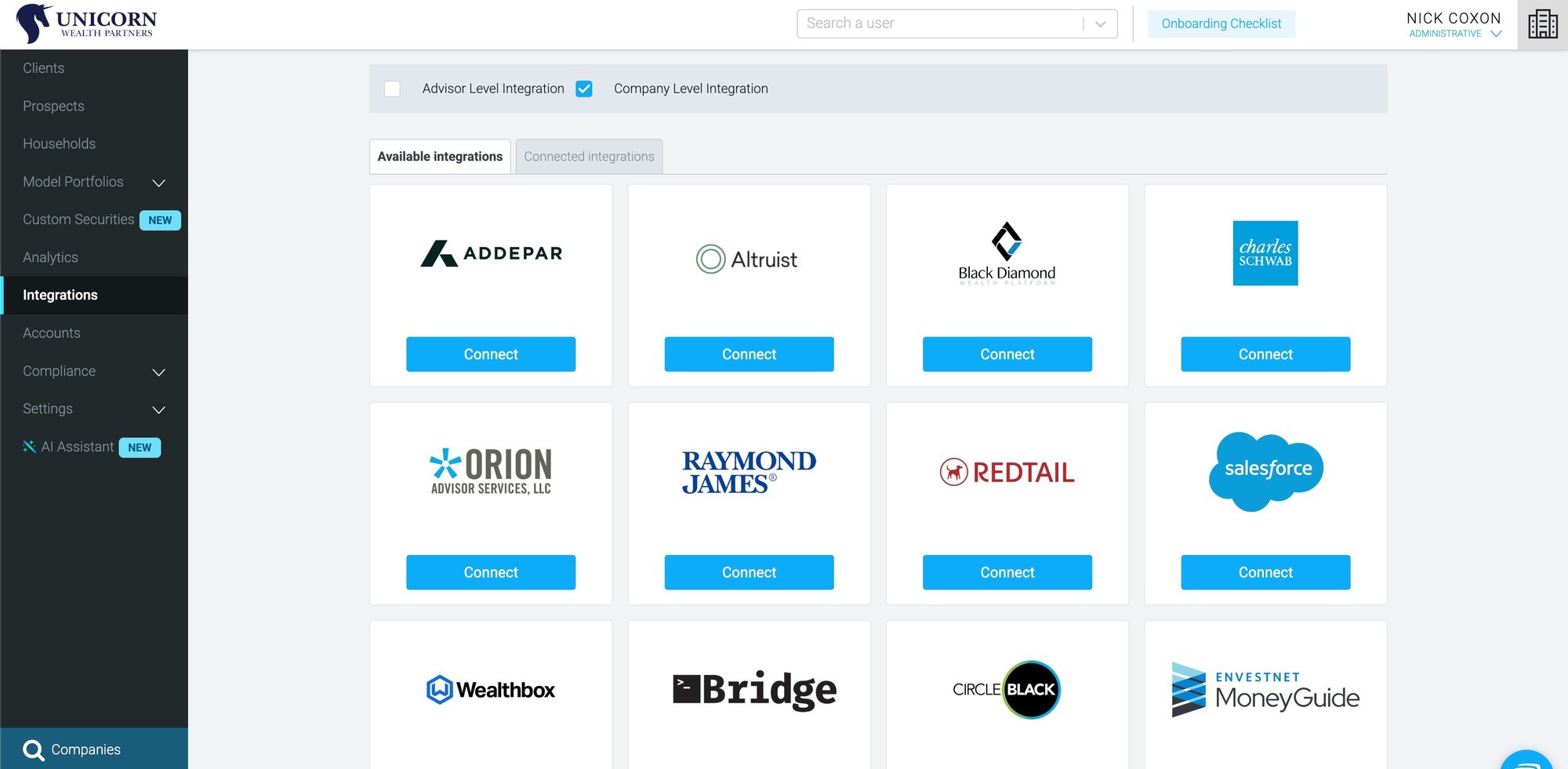

Connect Your Systems

Configure Our AI Compliance Engine

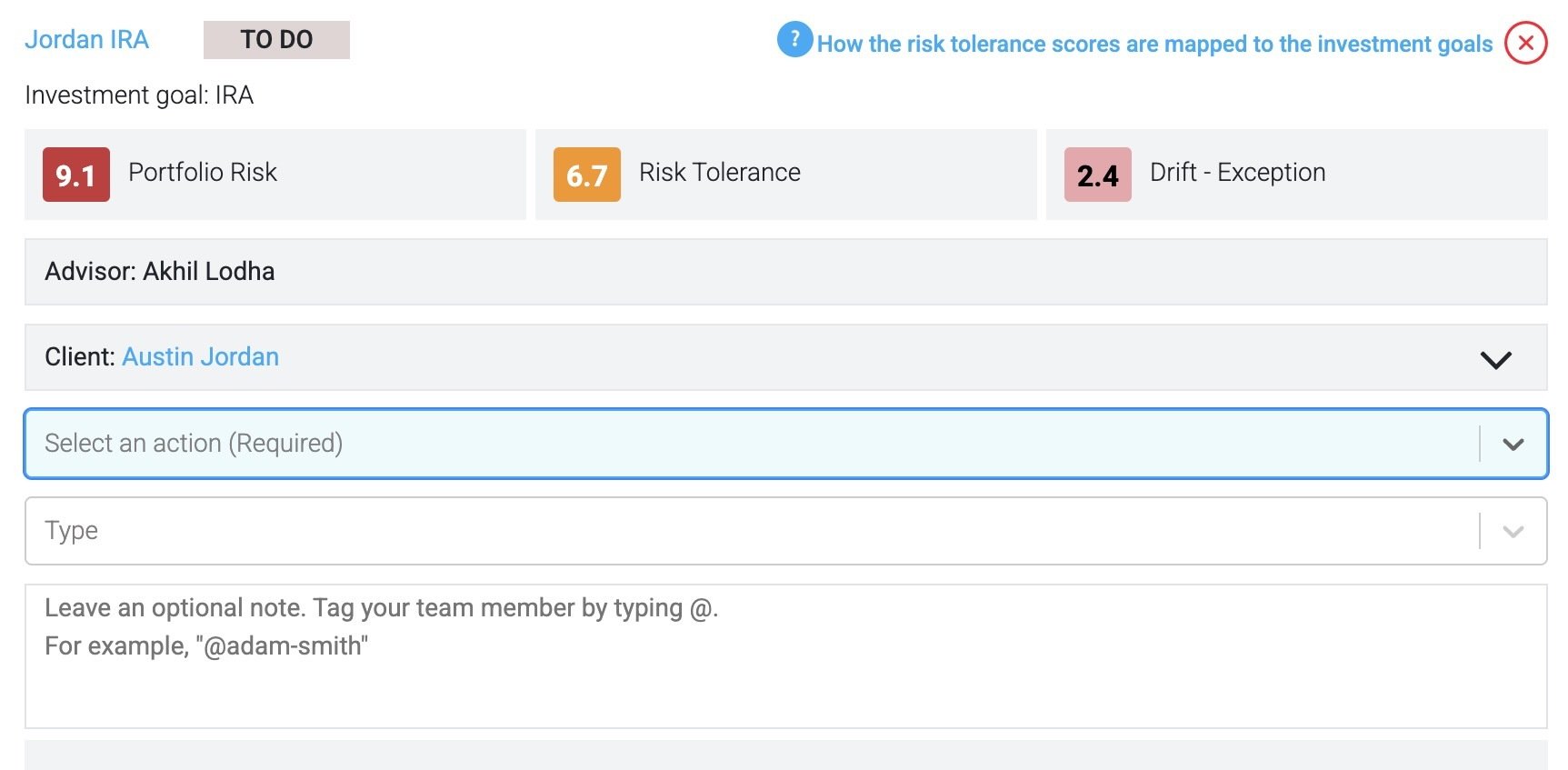

Automatically Catch Violations

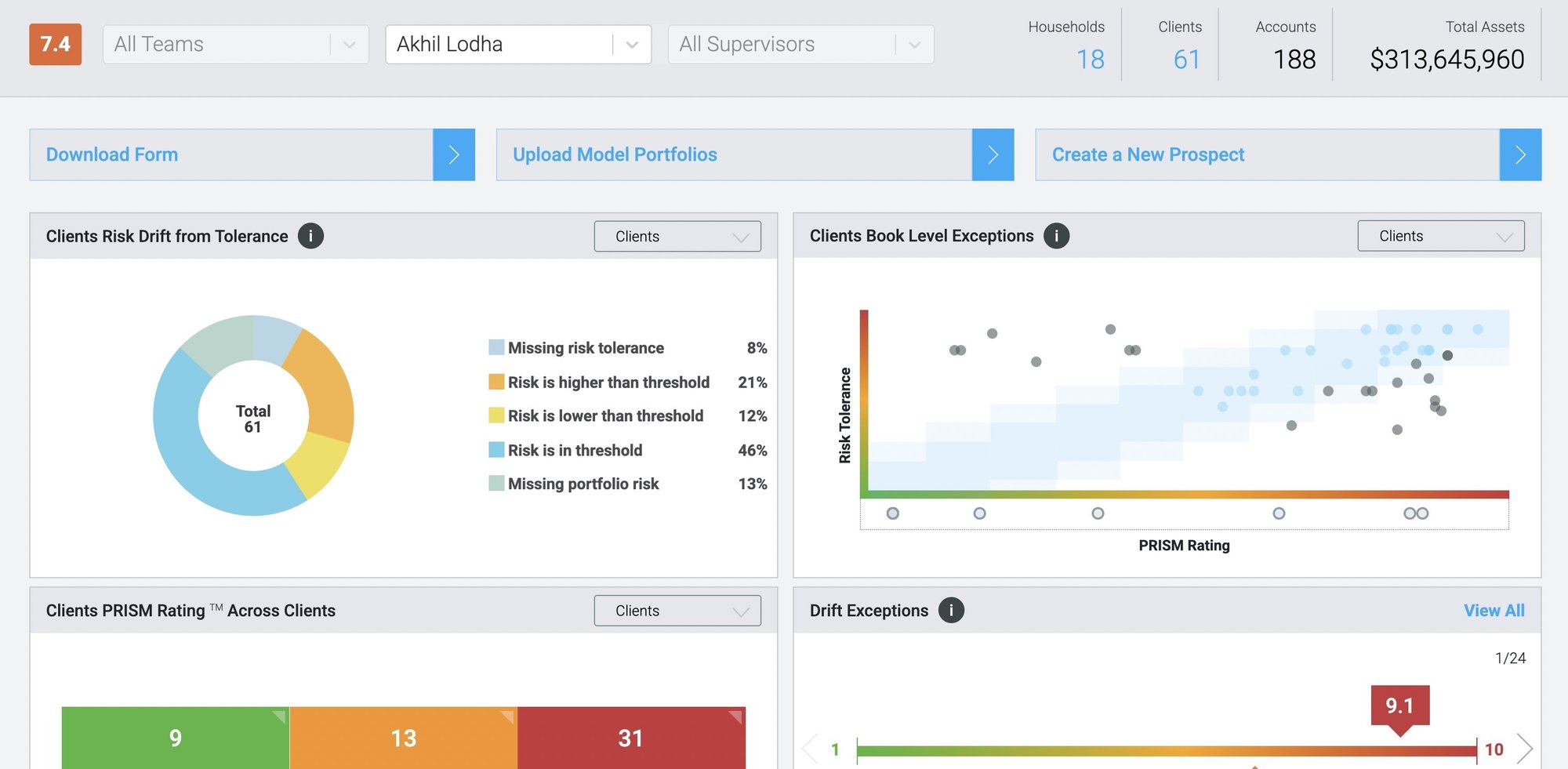

Get A Unified Compliance Monitoring Dashboard

Be the compliance officer who catches every violation before regulators do. While others struggle with manual monitoring and fragmented systems, you'll have total oversight across your entire firm.

Total Compliance Coverage

-

Share class violations

Automatic detection of mutual fund share class violations across all accounts

-

Concentration alerts

Real-time monitoring of concentration limits with drift detection

-

Suitability monitoring

Continuous monitoring of investment suitability with risk tolerance alignment

Full Advisor Oversight

-

Client review tracking

Manage advisor attestations and ensure timely client review documentation

-

Trading activity monitoring

Systematic analysis of advisor trading patterns and activity levels

-

Account, client & household level monitoring

Monitor accounts individually, or a client/household level

Always Audit-Ready Documentation

-

Integrated dashboard

Real-time visibility into all compliance exceptions with detailed documentation

-

Automated workflows

Centralized compliance workflows with assignment tracking and escalation procedures

-

Complete audit trail

Generate compliance reports and regulatory filings with historical records

Real Impact

- Time savings

- Proactive detection

- Perfect compliance record

Compliance Nightmares

- Cover only a fraction of accounts

- Constant switching between systems

- Exposure to $8.2 billion in SEC fines with $50 million penalties per firm

Peace of Mind

- Monitor all accounts automatically

- Unified compliance monitoring dashboard

- Zero regulatory violations with proactive alerts

What our customers are saying

"StratiFi has been a game-changer for me. In the past, other platforms I’ve used were not realistic with risk tolerance. But with StratiFi, everything makes sense. I feel more comfortable and confident sitting down with clients."

DeTray Investment Group

"StratiFi was able to help me (1) create a better digital experience for clients and (2) monitor compliance across multiple advisors who are running different strategies.”

NobleBridge Wealth

Management

"We wanted a risk profiling partner that shares our passion for leveraging technology to create better outcomes. After a year of due diligence, the technology, culture, and team at StratiFi were the perfect fit.

.png?width=53&height=53&name=Frame%201321319403%20(1).png)

UX Wealth

Protect Your Firm: Catch Violations Before Regulators Do

Your compliance thinking is sophisticated. Now get oversight data that matches your expertise with the total coverage your practice requires.

Transform compliance from reactive fire-fighting to proactive insights.

Frequently Asked Questions

We're here to help answers to some top questions from investors like you.

-

What is StratiFi?

StratiFi’s PRISM technology provides Factor-based risk analysis that is deep and robust. This allows you to distinguish between factors that increase upside potential from factors that reduce downside risk. Our client profiling questionnaire evaluates both risk tolerance and financial capacity to help you identify a suitable portfolio for your clients to meet their goals.

Our platform is sophisticated yet simple so you know what drives risk and can explain it to clients. -

Who uses StratiFi?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

How is StratiFi different?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

What type of investments does StratiFi support?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

What is StratiFi?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features