PolicyIQ

Convert Proposals to E-Signed Investment Policy Statements Instantly

Create client ready compliant investment policies and collect e-signatures in one uniform workflow.

The Problem

Each manual IPS costs hours of billable time, requires duplicate data entry effort and increases your exposure to potential fines.

Disconnected policy creation

Fragmented signature processes

Time-consuming customization

Creating professional IPS documents that reflect your expertise requires hours of formatting and customization for each client.

Increased compliance risks

The costly result

$500,000+ in Penalties

per advisory firm incident

SEC enforcement actions targeting documentation failures and without automated IPS creation, you're operating with compliance gaps that put your firm at risk.

Your Guide to Digital Investment Policy Workflow

Replace hours of customization with minutes of automation

Create unified workflow from proposals to e-signed policies

Client Discovery Compliant E-Signed IPS

Seamless Fact Finding & Data Gathering

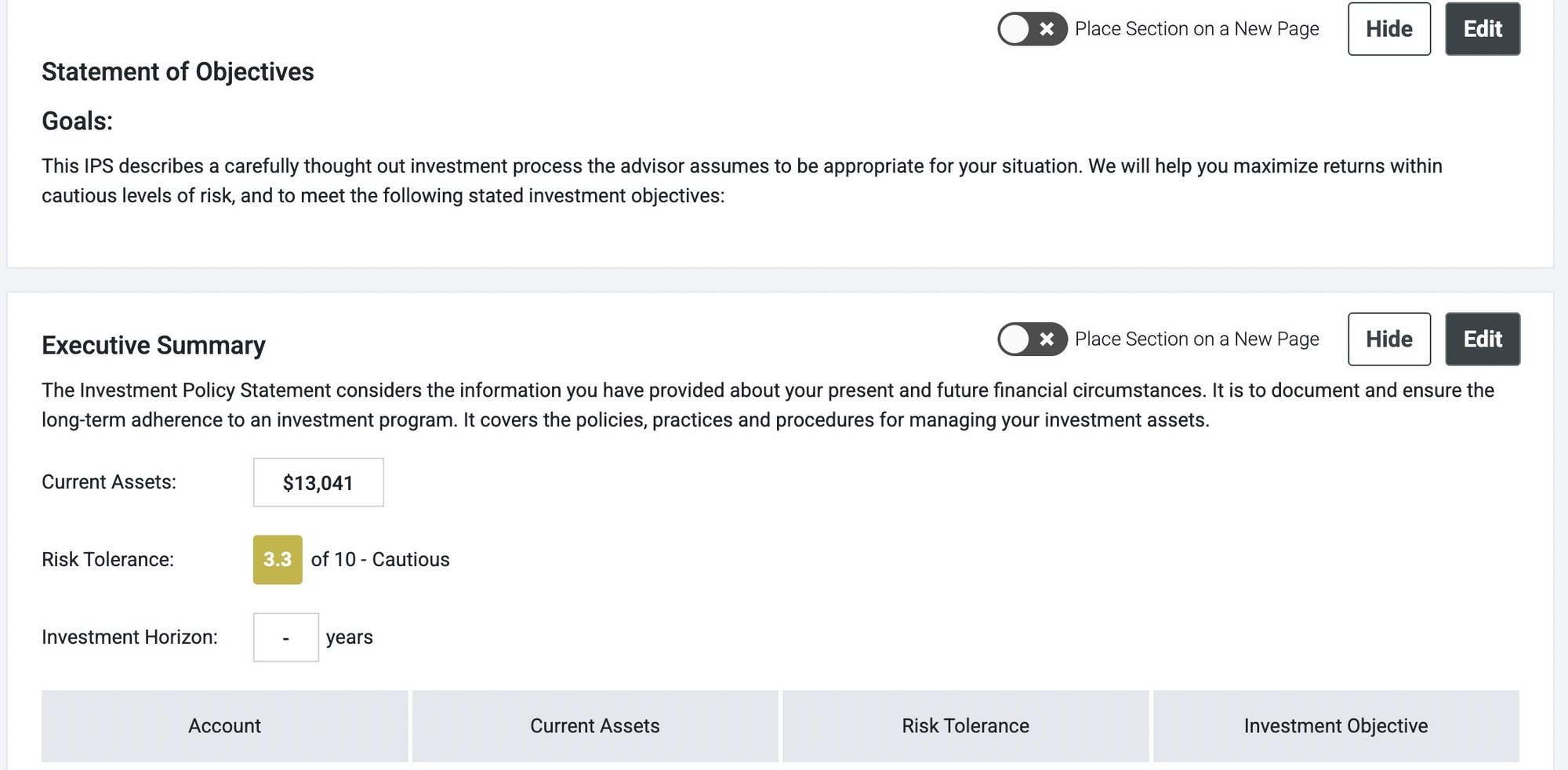

Complete Policy Customization

Customize every aspect of the policy with the same flexibility as your proposals, create drafts, and iterate based on client needs while maintaining compliance standards.

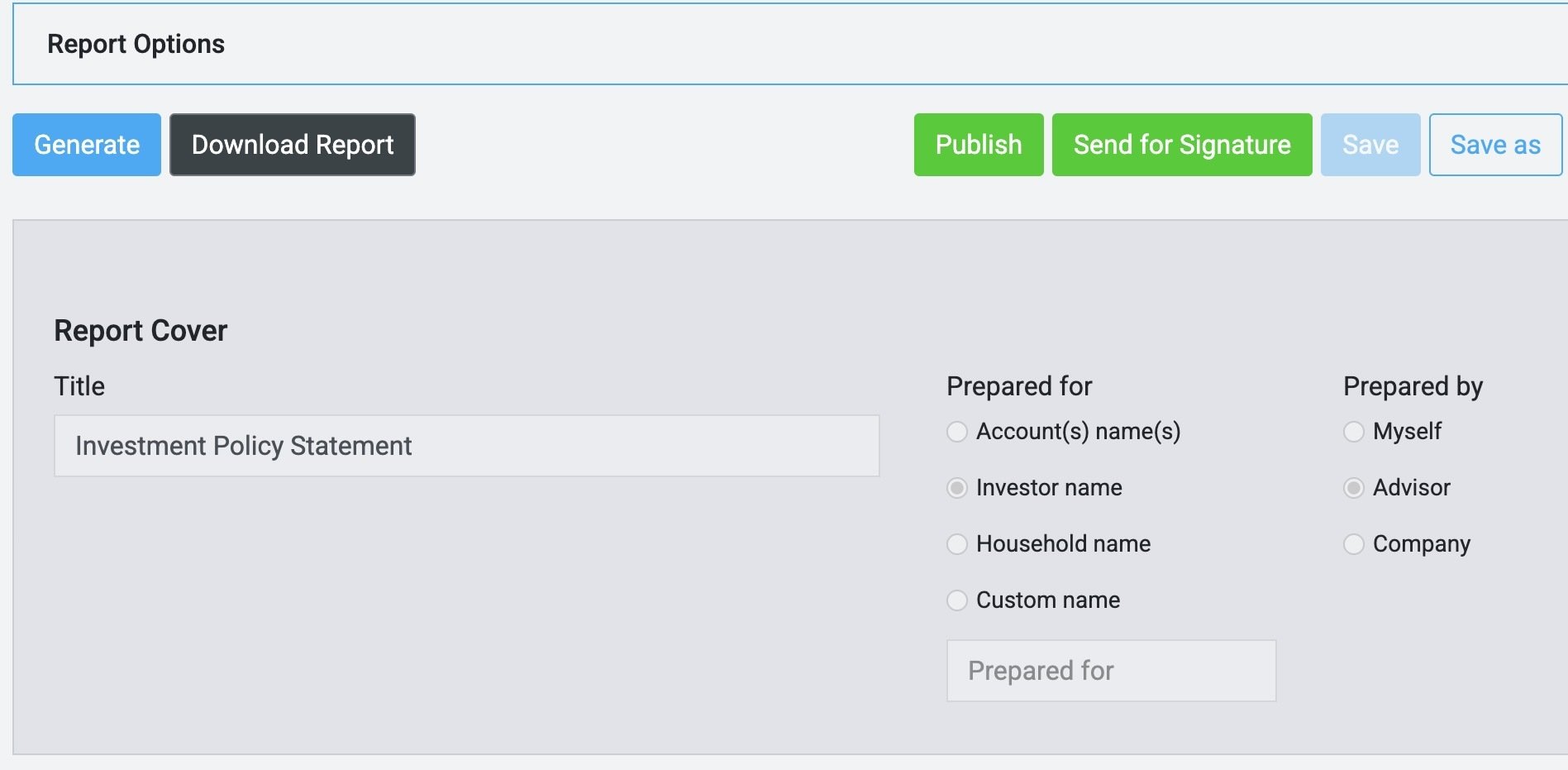

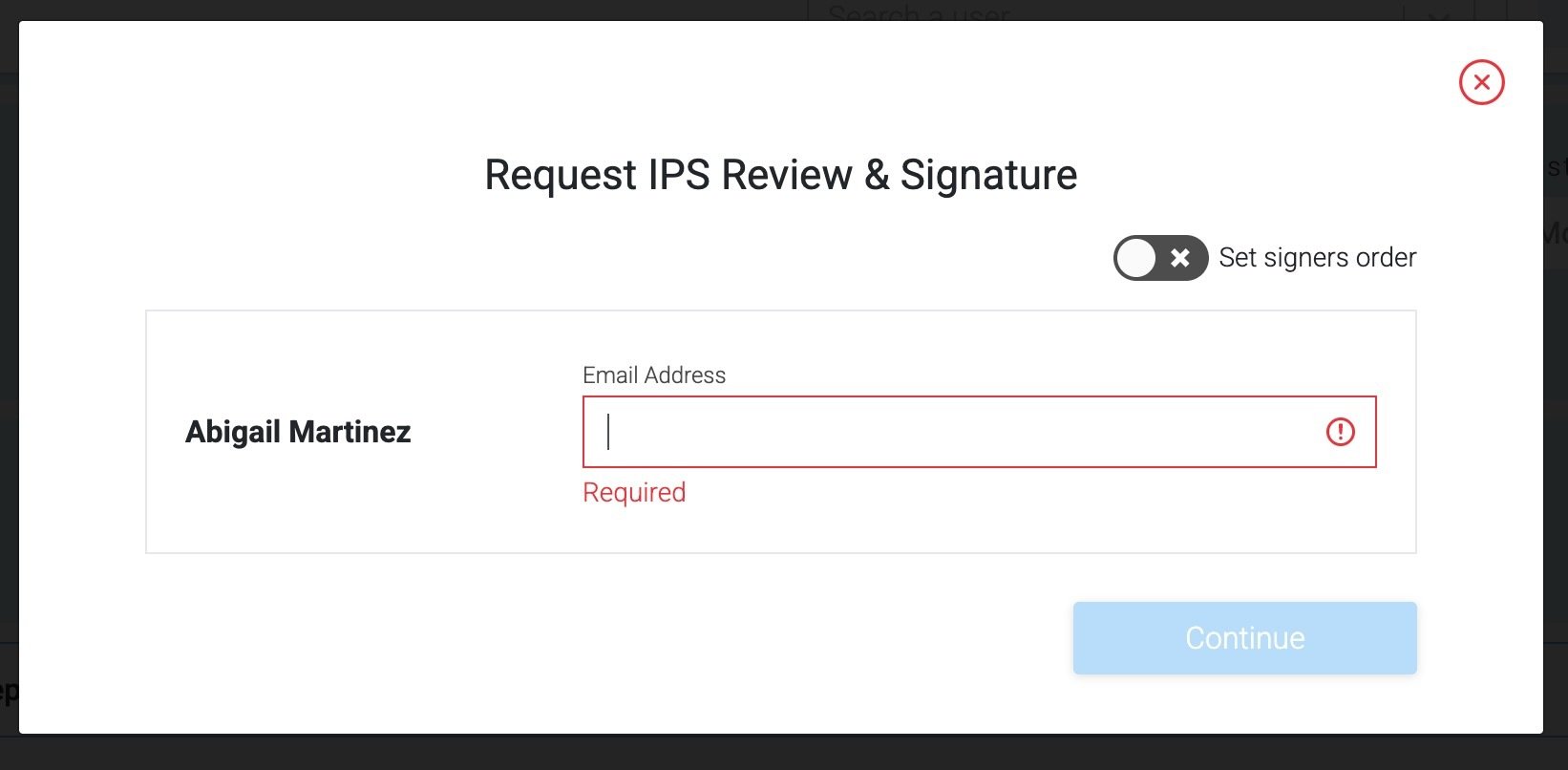

Built-in E-Signature & Documentation

Send for electronic signature directly from the platform with audit-ready records automatically saved and organized for regulatory compliance.

Created Digital Investment Policy Statements In Seconds

Automated policy generation that demonstrates your expertise and accelerates client onboarding.

Streamlined IPS Creation

-

Seamless data flow

Automatic population of asset allocations, model breakdowns, and client information from your existing proposals and discovery process

-

Customizable IPS templates

Templates that reflect your professional investment approach tailored to individual client requirements

-

Perfect consistency

Complete alignment between your investment proposals and policy documentation, eliminating compliance risks

Compliance Documentation

-

Audit-ready records

Automated organization and storage of signed policies with complete audit trails and version control

-

Regulatory compliance

Built-in compliance features that ensure your policies meet fiduciary and regulatory requirements

-

Professional standards

Branded policy documents that showcase your expertise and reinforce your professional image

End-to-End Digital Workflow

-

Onboarding acceleration

Transform lengthy manual processes into minutes of automated policy generation

-

Electronic signatures

Built-in e-signature capabilities with tracking and automatic record-keeping for compliance documentation

-

Simplified workflow

Seamlessly combine with data extraction and investment proposals for a complete client workflow from document analysis to policy creation

Real Impact

- 90% reduction in IPS creation time

- Zero compliance issues

- Faster client onboarding

Waste billable hours

- Duplicate data across systems

- Inconsistent documentation

- Fragmented signature processes

Automate policy creation

- More time for revenue-generation

- Achieve zero compliance issues

- Accelerate client onboarding

What our customers are saying

"StratiFi has been a game-changer for me. In the past, other platforms I’ve used were not realistic with risk tolerance. But with StratiFi, everything makes sense. I feel more comfortable and confident sitting down with clients."

DeTray Investment Group

"StratiFi was able to help me (1) create a better digital experience for clients and (2) monitor compliance across multiple advisors who are running different strategies.”

NobleBridge Wealth

Management

"We wanted a risk profiling partner that shares our passion for leveraging technology to create better outcomes. After a year of due diligence, the technology, culture, and team at StratiFi were the perfect fit.

.png?width=53&height=53&name=Frame%201321319403%20(1).png)

UX Wealth

Turn Client Data Into Signed Investment Policies

Seamlessly convert proposals into compliant IPS documents with e-signature workflow that saves hours and eliminates compliance gaps.

Transform policy creation from manual recreation to automated excellence.

Frequently Asked Questions

We're here to help answers to some top questions from investors like you.

-

What is StratiFi?

StratiFi’s PRISM technology provides Factor-based risk analysis that is deep and robust. This allows you to distinguish between factors that increase upside potential from factors that reduce downside risk. Our client profiling questionnaire evaluates both risk tolerance and financial capacity to help you identify a suitable portfolio for your clients to meet their goals.

Our platform is sophisticated yet simple so you know what drives risk and can explain it to clients. -

Who uses StratiFi?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

How is StratiFi different?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

What type of investments does StratiFi support?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

What is StratiFi?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features