PrismIQ

Institutional Risk Analysis For Modern Wealth Management Firms

The Problem

Basic risk tools only show volatility based on holdings while your sophisticated strategies manage concentration, tail events, and risk factors, leaving clients confused about your actual risk management.

Holdings-based risk scores are inaccurate

They don't capture the dynamic risk management in tactical strategies, momentum funds, and actively managed allocations that respond to changing market conditions.

Volatility misses tail risk protection

Alternatives require multi-factor analysis

Mutual funds & ETFs hide concentration risk

The costly result

78% of advisors

say portfolio risk is proactively brought up by clients

When you can't properly explain your enhanced strategies with equally enhanced risk analysis, you lose credibility and clients question whether you truly understand what you've built.1

Your Guide to Institutional Risk Insights

Multi-factor risk analysis for sophisticated portfolios

Explain the Why behind your risk scores with full risk insights

Holdings Risk Intelligence

Plug In Client Investment Accounts

Let AI Risk Engine Analyze Portfolios

Get Risk Scores With Intelligence

Showcase Your Modern Risk Management

While other platforms reduce your complex strategies to basic volatility scores, you'll have AI-powered insights that properly capture your expertise.

Institutional Risk Intelligence

-

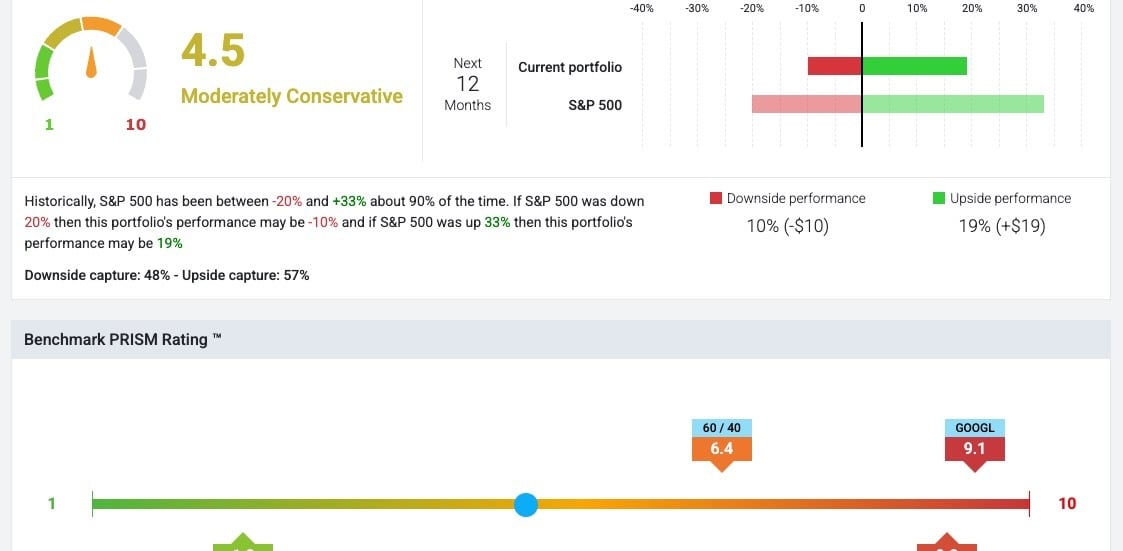

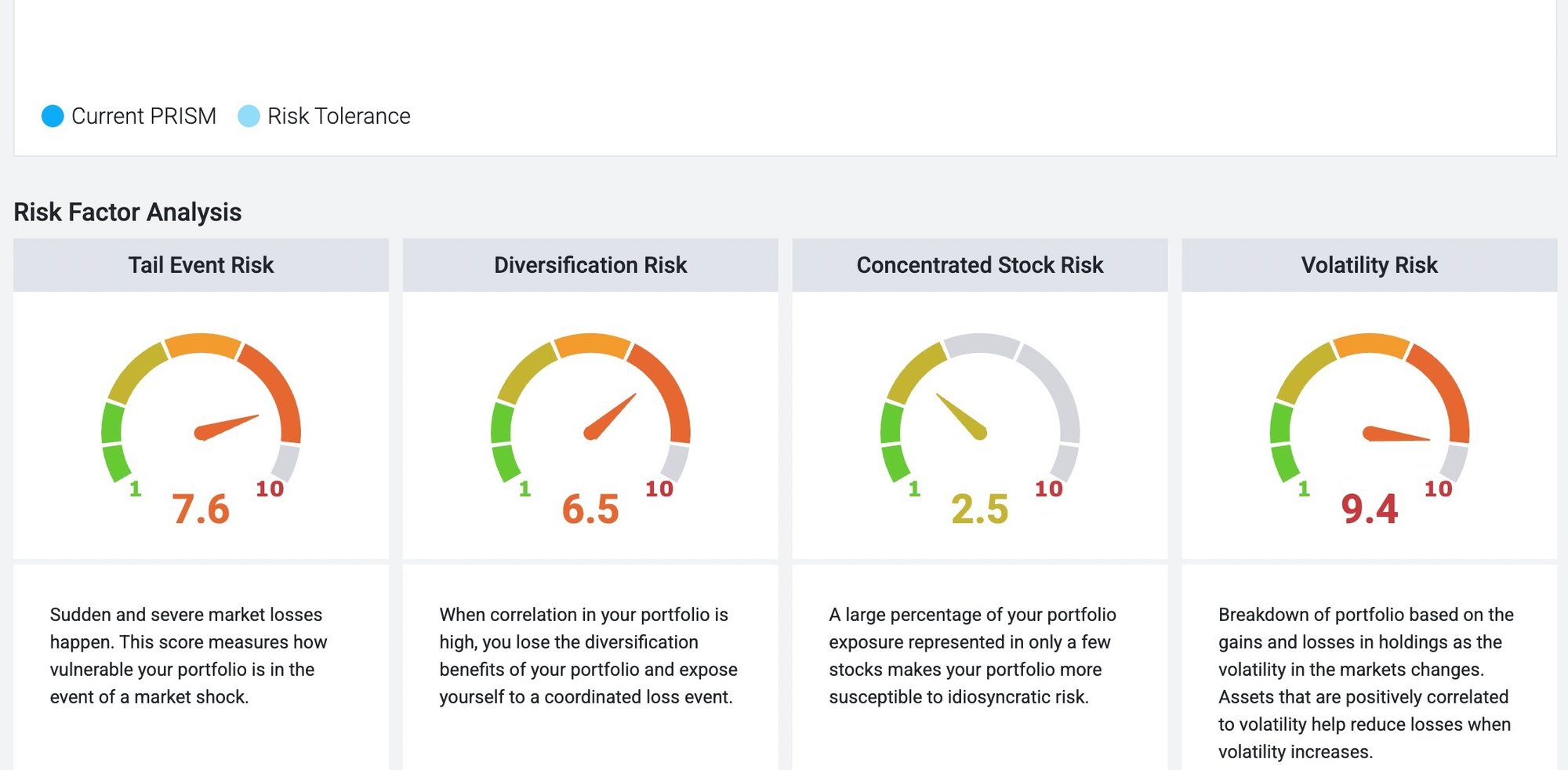

Factor-based risk modeling

Understand your risk exposure using concentration, correlation, tail risk, volatility metrics plus Fama-French three-factor analysis

-

Stress testing of portfolios

Model how your investments actually perform during market events, not generic volatility projections

-

Performance attribution analysis

Show clients exactly how each holding or strategy contributed to portfolio protection during market downturns

Modern Analytics & Reports

-

Alternative investment modeling

Proper risk assessment for REITs, commodities, hedged strategies, option overlays and buffer funds with specialized risk characteristics

-

Returns-based analysis for tactical strategies

Returns based analysis that demonstrates your modern risk management in tactical strategies

-

Holdings-based analysis of funds

Reveal concentration risk, leverage and sector exposures hidden in funds

Client Confidence & Communication

-

Expert client conversations

Transform conversations from "Your risk score is 65" to "Your buffer funds reduce tail risk by specific amounts"

-

Regulatory compliance documentation

Generate detailed suitability reports showing how complex investments align with client risk profiles

-

Visually intuitive reports

Generate detailed reports that demonstrate your modern risk management for compliance and client presentations

Real Impact

- Enhanced client confidence

- Professional credibility

- Differentiation from other advisors

Lose client credibility

- Risk communication gaps undermine expertise

- Clients question sophisticated investment decisions

- Regulatory exposure from inadequate risk documentation

Gain Client Trust & Get Referrals

- Multi-factor analysis matches investment sophistication

- Clients understand and trust complex strategies

- Complete regulatory compliance with detailed risk documentation

What our customers are saying

"StratiFi has been a game-changer for me. In the past, other platforms I’ve used were not realistic with risk tolerance. But with StratiFi, everything makes sense. I feel more comfortable and confident sitting down with clients."

DeTray Investment Group

"StratiFi was able to help me (1) create a better digital experience for clients and (2) monitor compliance across multiple advisors who are running different strategies.”

NobleBridge Wealth

Management

"We wanted a risk profiling partner that shares our passion for leveraging technology to create better outcomes. After a year of due diligence, the technology, culture, and team at StratiFi were the perfect fit.

.png?width=53&height=53&name=Frame%201321319403%20(1).png)

UX Wealth

Demonstrate Mastery of Modern Portfolio Construction

Your investment management approach is sophisticated. Your risk intelligence should be too.

Transform your enhanced risk management into clear, defensible intelligence.

Frequently Asked Questions

We're here to help answers to some top questions from investors like you.

-

What is StratiFi?

StratiFi’s PRISM technology provides Factor-based risk analysis that is deep and robust. This allows you to distinguish between factors that increase upside potential from factors that reduce downside risk. Our client profiling questionnaire evaluates both risk tolerance and financial capacity to help you identify a suitable portfolio for your clients to meet their goals.

Our platform is sophisticated yet simple so you know what drives risk and can explain it to clients. -

Who uses StratiFi?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

How is StratiFi different?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

What type of investments does StratiFi support?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

What is StratiFi?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

What types of trading services do you offer?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features