ScanIQ

Say Goodbye To Manual Data Entry With AI-powered Instant Document Extraction

Let AI instantly extract positions from any custodian statement and deliver immediate portfolio insights.

The Problem

Manual data entry is consuming 5-10 hours per new client and costing you $50,000+ per employee annually in wasted time.

Fragmented extraction across formats

Manual tasks waste 40% of work time

Document length creates bottlenecks

Different extraction & analysis systems

The costly result

$50,000+ per employee

annually in opportunity cost & non-revenue generating activities

At $100/hour fully loaded staff cost, employees spending 10+ hours weekly on manual data entry cost $50,000+ annually. When you can't instantly extract and analyze portfolio data, you lose prospects to advisors who demonstrate immediate value during the first meeting.

Your Guide to Instant Portfolio Analysis

AI-powered document extraction with instant portfolio analysis

Built for modern advisors who need speed and accuracy

Investment Statements Portfolio Insights

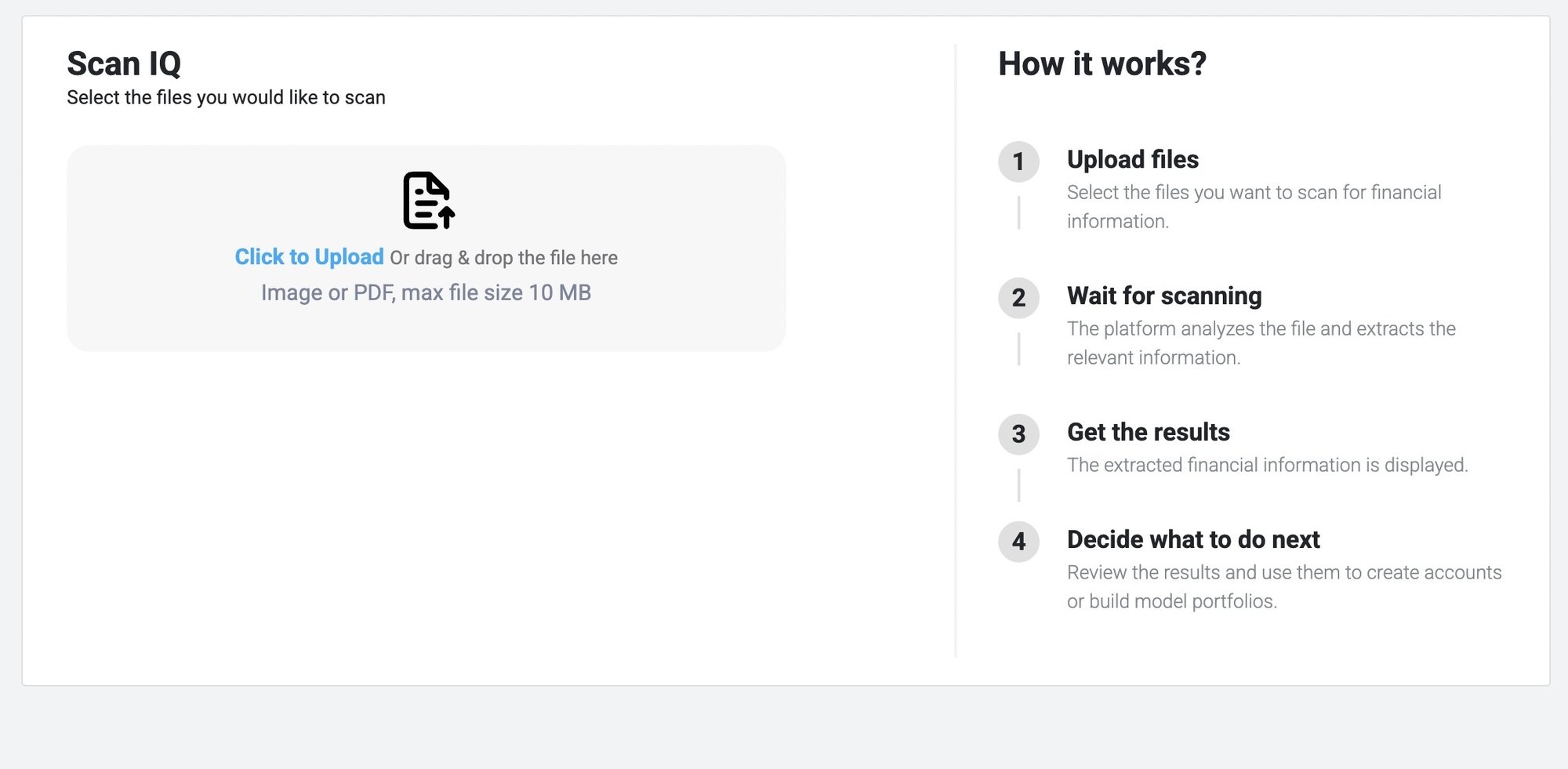

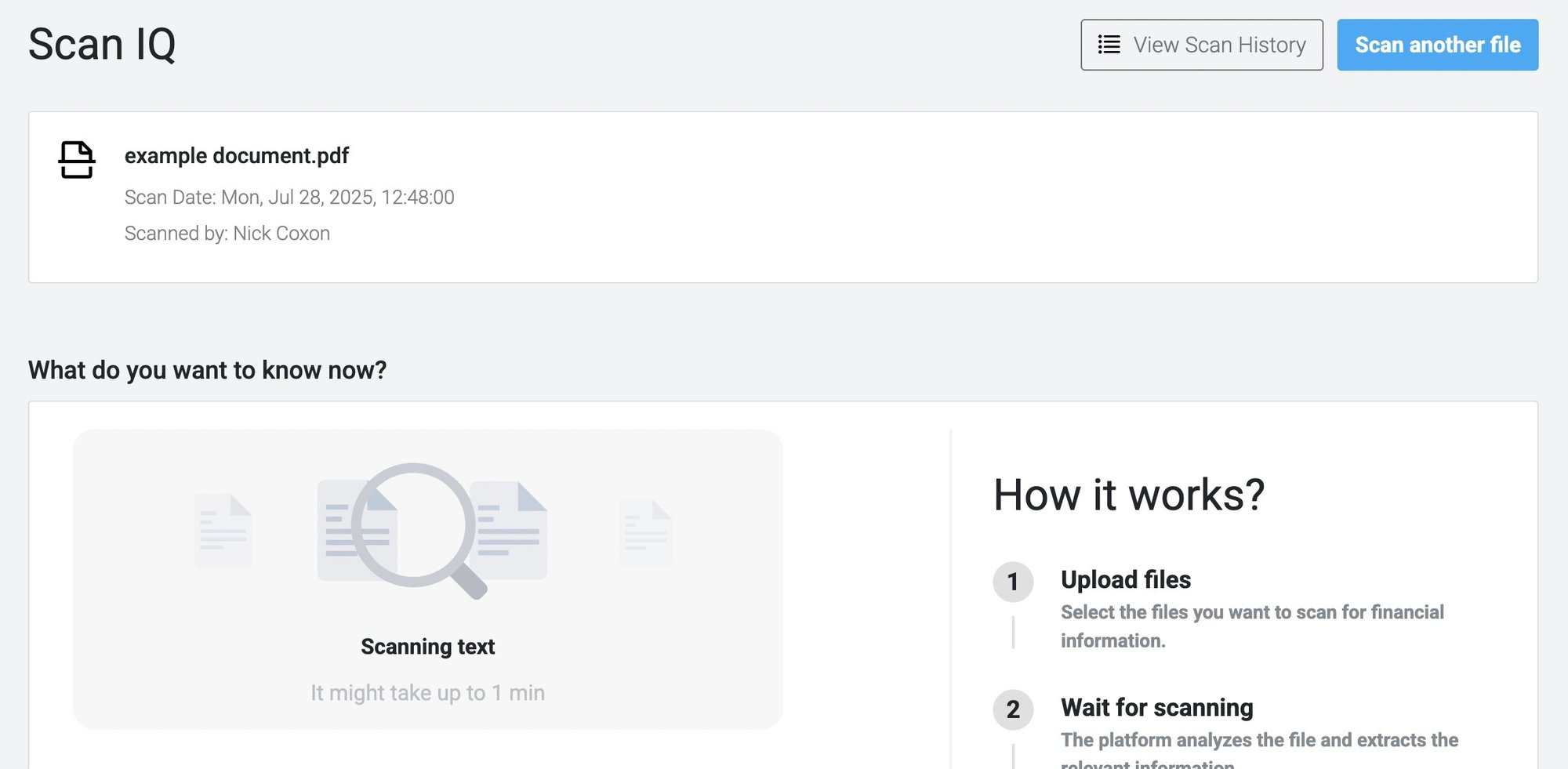

Upload Any Investment Statement

Drop in statements, PDFs, scanned documents, or even phone photos from any custodian, regardless of format, length, or complexity.

AI-Powered Data Extraction

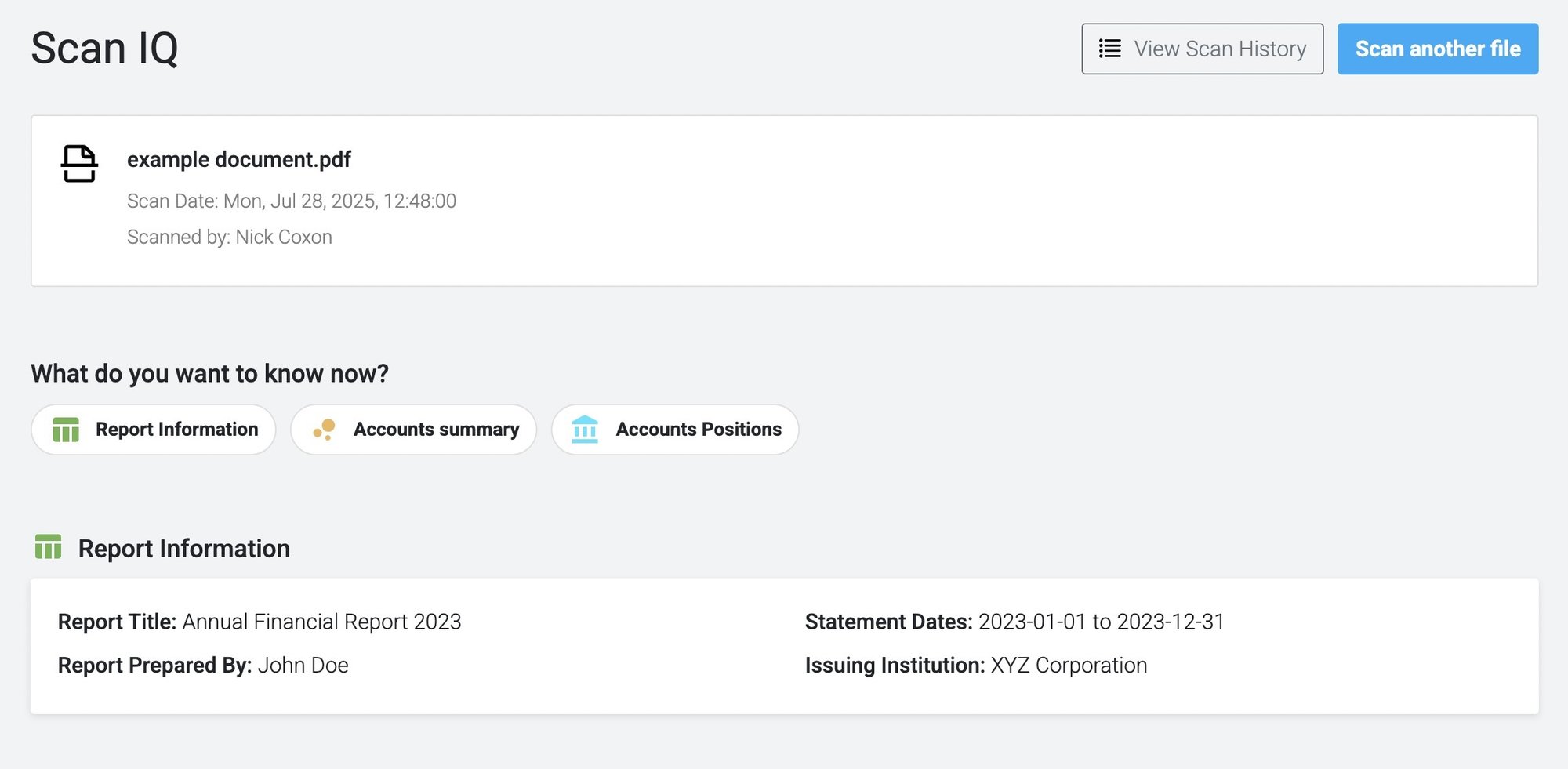

Immediate Portfolio Analysis

Get AI-powered Document Extraction With Instant Analytics

Advisors using AI-powered document processing report 90% reduction in manual data entry time, 10x faster client onboarding, and immediate portfolio analysis that close more prospects.

Total Document Processing

-

Universal format recognition

Automatically process any custodian statement format regardless of document length

-

Precision AI extraction

Enhanced machine learning identifies accounts, positions, shares, and cost basis with accuracy exceeding manual processes

-

Full asset coverage

Complete support for stocks, bonds, mutual funds, ETFs, and options with CUSIP identification

Immediate Portfolio Analytics

-

Instant analysis

Get sector concentration, geographic exposure, asset allocation, and top holdings delivered in seconds

-

Portfolio insights, not just raw data

Immediate portfolio statistics, risk metrics, and performance data ready for client conversations

-

Presentation-ready insights

Portfolio insights formatted for client presentations with customizable charts and tables

Workflow & Efficiency

-

AI-powered speed

Transform time-consuming 2-3 hour processes into a few seconds of analysis

-

Unified workflow

Seamless integration with document extraction and portfolio insights into one workflow

-

Custom AI adaptation

Specialized workflows that support structured products and alternatives

Real Impact

- 90% reduction in manual data

- 10x faster client onboarding

- More time on revenue-generating activities

Lose $50,000+ on manual work

- Manual data entry wastes 10+ hours weekly per employee

- $50,000+ annual opportunity cost per employee

- Prospects choose faster competitors

Unlock $50,000+ in productivity gains

- Process any document format in seconds, not hours

- Unlock $50,000+ in productivity per employee annually

- Showcase portfolio expertise that wins clients

What our customers are saying

"StratiFi has been a game-changer for me. In the past, other platforms I’ve used were not realistic with risk tolerance. But with StratiFi, everything makes sense. I feel more comfortable and confident sitting down with clients."

DeTray Investment Group

"StratiFi was able to help me (1) create a better digital experience for clients and (2) monitor compliance across multiple advisors who are running different strategies.”

NobleBridge Wealth

Management

"We wanted a risk profiling partner that shares our passion for leveraging technology to create better outcomes. After a year of due diligence, the technology, culture, and team at StratiFi were the perfect fit.

.png?width=53&height=53&name=Frame%201321319403%20(1).png)

UX Wealth

Convert Investment Documents Into New Revenue

AI-powered processing that demonstrates immediate value and closes prospects during the first meeting while saving you $50,000+ per employee annually.

Transform document processing from costly manual extraction to instant portfolio analysis.

Frequently Asked Questions

We're here to help answers to some top questions from investors like you.

-

What is StratiFi?

StratiFi’s PRISM technology provides Factor-based risk analysis that is deep and robust. This allows you to distinguish between factors that increase upside potential from factors that reduce downside risk. Our client profiling questionnaire evaluates both risk tolerance and financial capacity to help you identify a suitable portfolio for your clients to meet their goals.

Our platform is sophisticated yet simple so you know what drives risk and can explain it to clients. -

Who uses StratiFi?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

How is StratiFi different?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

What type of investments does StratiFi support?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

What is StratiFi?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features

-

What types of trading services do you offer?

We offer a variety of trading services, including stock trading, forex trading, commodities, and cryptocurrency. Our platform is designed to accommodate both beginner and advanced traders with a range of tools and features